The Answer – Very Little

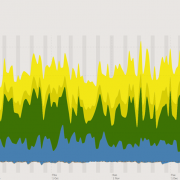

Examining the data from openNEM https://opennem.org.au/energy/nem/?range=1y&interval=1w in one day, three day, one week and three week periods to find the lowest renewable shares, it was possible to calculate how much renewable energy was delivered at those times. As a further check I looked at the peak demand day. Unfortunately because of the changing renewable mix and locations, looking back more than a year is not very useful, However at least as far as peak demand is concerned 31st of January 2020, was the highest demand day for 10 years.

To understand why backup is not a serious problem one needs to think about the power grid as an energy supply system rather than a power supply system. All reliable grids usually have about 30% excess power capacity. For example, in 2010 the NEM had 48GW capacity for a peak of 34GW worst demand. But grids also have excess energy capacity even at sensible capacity factors say 90% for nuclear 75% for coal 50% for gas and 15-50% for hydro. At those rates (obviously without nuclear) the NEM could have safely generated 280-300 TWh in 2010 but demand was only 210 TWh.

If a renewable system is designed to produce 280 TWh per year with 10-15 TWh from gas, then based on 14% CF for rooftop solar, 29% for tracking solar and 43% for additional wind it is possible to calculate the amount of generation required. One possible mix is about 40-50 GW of wind 20-30 GW of utility solar and 50-70 GW of behind the meter solar. Germany with about 20% of the area available for renewables as the NEM, already has 54 GW of onshore wind and 53 GW of solar so space is not a problem. Spain with an economy about the same size as ours plans to install an additional 60 GW of utility wind and solar by 2030, we only need an additional 55 GW, so if they can afford it why can’t we.

There will also be some biomass, waste to energy, landfill gas etc. and there seems to be a small revival in solar thermal with storage around the world and possibly some geothermal. Lets say in total there might be 2 GW of dispatchable, non hydro renewables and 10 GW of existing gas. With generator upgrades and 3 or 4 smaller pumped hydro projects there will be about 11 GW of hydro/pumped hydro but no increase in annual output from hydro.

Returning to periods of low renewable supply and calculating the current renewable generation on those days and multiplying them by the capacity increase eg if there was 5% of supply from wind, it was multiplied it by 8. If utility solar supplied 3%, it was multiplied it by 9, rooftop solar by 5 and so on and on only a very few days per year did renewables not supply more than 60% of the energy. On most days, outside Tasmania, neither hydro nor gas were required at all or ran at 10-20% of capacity for 1-4 hours

On the worst days I used Anero.id https://anero.id/energy/2020/May/5 to check the 5 minute minima and I found that even running 11 GW of hydro and 10 GW of gas and 2 GW of other at 85% there are still gaps. There is still a need for backup, however the periods are quite short. The worst case I could see was about 15 GW for 30 mins trailing off to zero in around 12 hours. Other longer lower production periods would need to run gas and hydro for perhaps 70% of the time ranging from 10-90% capacity but need little additional backup. Put a different way, the longer the period considered, the the closer to average the renewable output will be, so the less long term backup will be needed. By illustration the worst renewable hour was 9% of supply, the worst day was only 17.3% of supply, the worst renewable week 20% and the worst renewable month 22%, the annual average was 25%

There are many forms this backup can take, grid batteries almost being the last in the queue, although they do have fantastic advantages in frequency and voltage control. The cheapest backup is flexible demand. Even on the hottest day at least between 10 and 2 there will be excess solar, so a smart grid will use the excess to run hot water heaters, move municipal water around, make ice or freeze phase change materials in cool stores, precool residences etc, to drive down evening demand. I am not a great fan of home batteries but many customers are and it is quite likely that most of them will be linked into Virtual Power Plants. In the US attachment rates for batteries on home solar are running around 30%. In 10-15 years time we will have 5-7m behind the meter solar systems. if only 1/3rd of them have batteries which can only contribute 2.5 kW for 4 hours, mostly by self consumption but also by feeding excess power back to the grid. That is around 5 GW reduction in grid load.

Initially I was opposed to batteries at generators because for a whole variety of reasons, storage near the load is more effective. It reduces grid losses by reducing peak transmission loads and eventually the need for expensive upgrades to Transmission &Distribution assets. It also protects against transmission as well as generation failure.

However grid management and price stability is much easier if most wind and solar farms have some sort of storage, not necessarily a large capacity, even 10% of the peak capacity for 30 minutes, can improve managability and profitability of a wind or solar farm, while simplifying grid access. (see Dalrymple in SA)

If current trends hold, in 5 years time a wind farm will cost about $1.6m/MW to build and 3 hour storage about $0.5m/MW so adding 15% storage to a wind or solar farm will only increase costs by about 5-10%, By avoiding curtailment and selling some power at evening spot price at say 3 times day minimum it is not hard for batteries to pay for themselves. If the above forecast of capacity is correct, then when wind and solar are fully built out and 70% of facilities have 15% storage attached (hydrogen, pumped hydro, batteries, power to heat for nearby industry, whatever) that is about 7 GW peak capacity so combined with gas, hydro, customer batteries and flexible demand there should be adequate capacity 24/7/365.

Smart charging of EVs will also be a big part of the solution and even some V2G (Vehicle to Grid) on 5-10 days a year. Most cars only need to be charged off a single phase home or work charger for about 8 hours a week (20-50KWh = 170-450km/week) and on average at full charge carry a weeks worth of energy. So in an emergency it is easy to limit charging for 4-5 hours to perhaps 2-3% of vehicles. The rest of the time they can soak up excess wind and solar. While EV penetration is contentious, next year in Europe EV share is expected to be around 20% so by 2030 probably 75-80%. That would mean by 2030 almost half the vehicles on the road would be electric or plug in hybrid. Lets say in Australia it is only 15% (3m) and of those 20% are capable of supplying V2G and at any time half of those in turn are plugged in (i.e. 350,000 or 1.6% of registered vehicles) and make half of of their battery capacity available, that is another 2 GW/20GWh.

There are many ifs and buts in this scenario but I have been studying this in detail for seven years and so far my predictions of renewable penetration have turned out to be underestimates. In 2014 I assumed supportive government policy and underestimated the difficulties in grid connections, bankruptcies of contractors etc. But I forecast, (accoding to others, an unbelievably optimistic) 24% renewables for the year 2020 including 12 TWh of solar. This year the NEM will actually hit 26% renewables and probably 19 TWh of solar. This is despite this year being cloudier than last year and therefore renewable capacity factors are down. Even if next year weather isn’t any better, there is enough capacity being installed to increase renewable share by another 6% to 32%.

On the other hand there is a huge amount of development work being spent on smarter solar trackers, special coatings for panels etc – not to increase peak power but to improve efficiency on cloudy days and early and late in the day. Similarly new wind turbines are being optimised to generate power at lower and lower speeds, so that rather than put a 4.5 MW generator behind a 126 m rotor on 90m tower for less money you can put a 3.5MW generator on a 130m tower with a 155 m rotor. The taller tower and larger rotor will catch more and faster wind, so will probably generate just as many MWh per year, but most importantly will be generating twice as much power when the winds are light so it needs less backup. Thus the system cost is lower. My calculations above do not include any such advanced technologicalsolutions.

To summarise the short term storage, 1-12 hours will either be installed by economic actors or, like the Victorian Big Battery, to obviate the need for much more expensive transmission upgrades. One interesting example is that transmission upgrade required to make Snowy II useful to Victoria could be completely eliminated by about 4 of these batteries for about half the cost.

As an aside, in practical terms the whole Snowy II project including transmission and extra generation to make up for the pumped hydro losses will cost $8-10 bn and cause significant environmental damage. Based on the costs of the latest large scale battery projects, 3 GW eight hours (2GW x12 hours) of batteries distributed thoughout the grid would provide more practical support, reduce system losses and bushfire threats and cost about $5-6bn

In summary a 95% renewable grid needs little to no storage that won’t be installed by generators and customers for their own economic reasons. For longer term backup we already have hydro and gas.

——————————

Peter Farley FIE Aust

——————————